Every business owner will, eventually, transition—meaning they will either pass the ownership to someone else, sell the business, or make arrangements for a successor—whether on their own plans and timeline or due to circumstances beyond their control. I recently worked with a seventh-generation family business and, although the business has remained owned by the family, it has transitioned seven times! Yet, according to the 2019 The Exit Planning Institute State of Owner Readiness Survey, most business owners are not prepared for a transition:

- 83% either do not have a transition plan or “have” a plan that has not been documented or communicated.

- Of those that do have a plan, only 13% have completed strategic analysis and value enhancement planning only and only 12% have detailed action plans.

- 50% do not differentiate between management and ownership transition.

- 14% of respondents in the 60-69 and 70+ age brackets have NO plans to transition their business.

- 40% of respondents do not have a plan that covers a “forced” exit (illness, death, etc.).

- 81% of respondents have no written strategic plan, yet 67% expect to make strategic decisions regarding the company as part of their exit strategy.

Understanding Exit Planning: Differentiating Exit Planning from Event of Exit

So, when is the best time for you to begin exit planning? The answer is now. “But I’m not planning to exit now,” you might think. There seems to be a disconnect! It’s no wonder we tend to equate exit planning with exiting. When you hear about businesses involved in mergers and acquisitions, the focus is almost always on the selling price or the EBITDA/cash-flow or some multiple that was achieved. However, exit planning and the event of the exit are not the same thing. M&A professionals along with investment bankers and business brokers focus on the event of exit because that’s how they get paid. Their objective is to maximize the price the business owner receives for the business as it exists at the moment of sale.

Exit planning is different.

Peter Christman, co-founder of the Exit Planning Institute (EPI) stated that: “Exit planning is achieved through developing a business transition plan that addresses three things:

- Maximizing the value of your business

- Ensuring you are personally and financially prepared, and

- Ensuring you have planned for the third act of your life.”

- The Value of Exit Planning: Maximizing Business Value is a Mutual Goal

The selling price someone is willing to pay you for your enterprise is the enterprise value as perceived by the buyer. The things that increase enterprise value are identical for the business owner and the buyer.

So logically and given the inevitability of some sort of transition, business owners should be motivated to run their business in order to maximize the value of their business, but most focus solely on the income it generates to support their lifestyle. The income that a business generates is important, however, focusing exclusively on income is a mistake. It’s only valuable to another owner if it’s predictable and transferable.

Exit planning helps business owners do just that—increase the predictable and transferable value of their business—and it is simply good business strategy.

When is the Right Time to Begin Exit Planning? Start Now

“Begin with the end in mind.” I think the first time I read this was in Steven Covey’s book, 7 Habits of Highly Effective People, but it has become a common phrase for planning and goal setting. It makes sense to be working towards something rather than simply working. Having a clear goal in mind helps to focus on achieving the goal. This is a truism, but it’s especially relevant for business owners since business ownership is a journey.

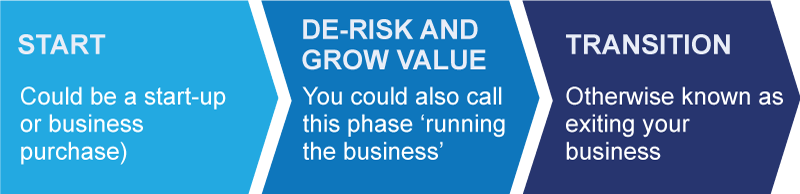

The Phases of Business Transitions

In my experience, here are the three phases every business, and I mean EVERY, business goes through:

Common Obstacles to Exit Planning

So why wouldn’t every business owner want to create a business transition plan now? Some business owners don’t think of their business as an investable asset and are only working IN their business and spending very little time working ON their business. Chris Snider from EPI notes several reasons he has heard from business owners about why they haven’t completed or even begun exit planning:

- FEAR: Business owner is afraid of getting old,

- NEEDS THE INCOME: Business owner feels trapped and completely reliant on the income generated,

- UNKNOWN NEXT ACT: The business owner doesn’t know what to do next if not running the business,

- SSSHHHH: The business owner doesn’t want anyone to know they’re considering exiting the businesss

- TOO BUSY/NO TIME: Business owner claims she/he has other more important priorities,

- MISINFORMED: The business owner doesn’t know her/his options.

- DOESN’T WANT TO EXIT - EVER

Embracing the Inevitability of Business Transitions

Perhaps for the reasons Chris Snider notes above, many business owners completely avoid the word “exit” despite the fact that it is a certainty that every business owner will eventually transition or exit. It’s not a good thing or a bad thing, but it will happen. There are several transition options, and it is important that a business owner knows what they are - that’s part of the exit planning process. The transition can be internal: intergenerational transfer, management buy-out, sale to an existing partner, or to employees through an ESOP. Or the transition can be an external transaction: to a third party, recapitalization, or make an orderly liquidation.

The Benefits of Having an Exit Plan: Gain Peace of Mind and Control

Having a business transition plan prepared makes the date of the eventual transition/exit irrelevant and often results in peace of mind for the business owner. It is almost always better for the business owner to be in control over the manner and timing of a transition. If, however, circumstances impose a transition/exit, at least the business and its owner will be prepared and likely have a business transition more closely aligning with the owners’ wishes.

Plan Your Business Exit with Confidence

Exit planning is a strategic process that maximizes your business's value, ensures personal and financial preparedness, and charts a successful path for the future. With the inevitability of business transition, starting exit planning early is a wise strategy.

Discover how a Fractional CFO can help you navigate building transferable value and put plans in place for a successful exit on your terms. Reach out today for a complimentary consultation.

Peter Geise is a CEPA (Certified Exit Planning Advisor) and Akron Area President for FocusCFO. He is an accomplished business executive with over 30 years of experience leading both domestic and international businesses, from Fortune 100 companies to small, family-owned enterprises. He’s passionate about creative problem-solving and big-picture thinking, and he prides himself on having a reputation of unquestionable integrity. Peter is deeply involved with his community and participates in several councils and advisory boards