Whether it is planning and executing a financial strategy, reducing expenses, or even getting corporate buy-in, CFOs often face some of the biggest challenges at their companies. These hurdles become even more difficult in a less-than-optimal economic climate, intensifying the stress levels of your leadership team. As economic growth continues to slow and a recession looms, we teamed up with our business partners at ITR Economics to provide some helpful data and insights that will help CFOs tackle their biggest challenges for 2023.

Recession in 2024

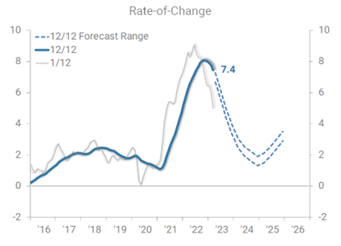

ITR Economics, a firm known for its forecast accuracy, is predicting that a macroeconomic recession will begin toward the end of 2023 and persist throughout 2024. This recession forecast stems from the increases the Federal Reserve Board made to the federal funds rate back in 2022 in its effort to combat high inflation.

While continuing to stay on top of the Fed’s latest actions, ITR Economics is also helping business leaders prepare for the recession – so they can thrive during it – by providing accurate data and clear, actionable advice.

The mere thought of a recession may be alarming for your team, as many of your employees could become fearful for their own jobs as well as the future of the company. An economic downturn requires CFOs and other business leaders to be agile and proactive and to keep a strong and positive mindset, reinforced by accurate information and strong planning.

High Inflation

As CFOs know, the high inflation of the last 24 months is waning. Expect inflation to return in 2025 and be part of the economy through the rest of the 2020s.

On the bright side, disinflation will continue through the remainder of this year and in 2024. This insight comes from ITR Economics’ forecast for the US Consumer Price Index, which can be accessed with a free trial of ITR Economics’ Trends Report™ service.

Consumer Inflation Forecast via the US Consumer Price Index

Forecast published April 18, 2023, in ITR Economics’ Trends Report™

An easing in the rate of inflation over the next 18 months will be welcomed by most businesses and individuals. It is best to remember that the respite is temporary.

Disinflation and wage increases will allow individuals to keep spending, but you can expect them to be more selective in their purchases in the coming 18 months due to the ongoing nagging pressures of inflation and recession-related fears.

Business leaders need to be sure to have profitable products or services ready and available in an economic climate where “better” is likely to be the most appealing choice in a good/better/best scenario.

How CFOs Can Help Businesses Prepare for Inflation

Beyond just managing the financial health of the company, an important responsibility of the Chief Financial Officer is divining, and then navigating, the financial roadmap for the business. That financial roadmap synthesizes the business strategy with its numbers, and then attempts to incorporate macro trends in its industry and the overall economy.

In the face of evolving economic conditions and forecasts, it's imperative for CFOs to proactively adjust that roadmap to build resilience to negative events or shocks, while continuing support for its growth plans.

Here are some key strategies that our CFOs employ in helping prepare clients for uncertainty:

- Scenario Planning: Developing various economic scenarios, both optimistic and adverse, allows us to tailor financial strategies for each scenario and respond rapidly, with a pre-planned playbook, to changes in the economic environment.

- Cost Management & Pricing: In times of high inflation, effective cost management takes on added importance as CFOs seek to protect margins. However, in times of increased inflation, equally important is developing a strategy for price increases to help cover those cost increases that must be absorbed. Without a proactive approach, businesses can ‘wake up’ one day to find their operating margins materially squeezed.

- Cash Flow Management: ‘Cash is king’. Even more so in the face of an economic downturn! Proactively improving cash cycles and taking down credit lines all help to build working capital reserves. A solid cash buffer is key to resilience, and positions businesses to seize opportunities when the economy rebounds.

- Profitability and Health Analysis by Customer and Service Line: Such analysis is ‘bread and butter’ for a skilled CFO, as they seek to improve profit margins of the business. Understanding this profitability breakout helps the business maximize its return on capital and other resources expended. But in uncertain economic conditions this analysis takes on an additional, and quite critical, dimension of Risk Management. Customer concentration typically implies a degree of risk to the business from a small number of customers who contribute to a disproportionate amount of the business’s cash flow. This risk from concentration increases significantly during economic downturns. During these times, the CFO may dig deeper into its customer base to evaluate which customers (and suppliers) may be most sensitive to higher inflation and/ or an economic downturn, incorporating these risks into their forecast scenarios, and then proactively seek to mitigate these risks through greater diversification and other hedging.

Prepare Your Business for the Uncertainty with Actionable Insights from FocusCFO and ITR Economics

In an era of complex economic dynamics, strong financial leadership becomes crucial. We believe that with the right preparation and proactive measures, you can not only withstand any economic stresses but also turn them into opportunities for growth and resilience.

Business owners don't have to navigate these uncertain waters alone. At FocusCFO, we're here to help every step of the way. Our fractional CFOs can leverage ITR Economics’ world-class forecasts & insights to provide your business with guidance to steer its course toward resilience and success. The key is to stay informed, be proactive, and lead with confidence.

That's why FocusCFO is proud to focus with ITR Economics. The detailed analysis and forecast accuracy from ITR Economics helps keep us informed, giving our fractional CFOs the tools they need to shape proactive financial management strategies for FocusCFO clients.

If you're looking to bolster your strategic financial management in these changing times, schedule a complimentary consultation with us. Together, we can shape the future of your business and build sustainable, transferrable value.